The Bitcoin market has been in the spotlight recently as the price of Bitcoin continues to climb higher. Meanwhile, a new stake-to-mine Bitcoin alternative called Bitcoin Minetrix is making waves with its successful ICO, raising over $4 million. In this article, we will analyze these developments and explore the potential impact they could have on the cryptocurrency market.

Despite recent volatility and profit-taking, Bitcoin has shown resilience by retracing higher towards the $40,000 mark. In the past 24 hours alone, it has gained 4.2% and reached a price of $37,422. This surge is part of the cryptocurrency’s overall performance this year, with a remarkable 123% increase in value, outperforming other asset classes. Investors and market participants are now eagerly anticipating the approval of a spot Bitcoin ETF by the US Securities and Exchange Commission (SEC), which could potentially drive even larger gains in the future.

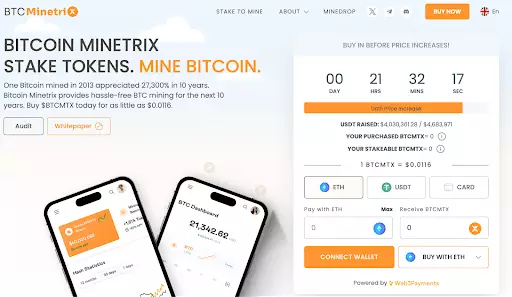

Bitcoin Minetrix ($BTCMTX) has emerged as a popular investment opportunity, attracting significant attention and investment during its presale phase. This unique crypto asset tokenizes the cloud mining of Bitcoin, providing users with the opportunity to stake the native $BTCMTX token and receive cloud credits for mining Bitcoin. With advantages such as ease of use, low entry costs, and protection against scammers, Bitcoin Minetrix has garnered over $4 million in funding. This success can be attributed to growing expectations of a spot Bitcoin ETF approval and the increasing demand for Bitcoin-related coins as alternative investment vehicles.

A major milestone for the cryptocurrency market would be the approval of a spot Bitcoin ETF. The recent announcement by BlackRock, the world’s largest fund manager, that it has applied to launch a Bitcoin ETF highlights the growing interest from institutional investors. This approval could unlock billions of dollars and provide a regulated route for financial advisors and pension fund managers to invest in Bitcoin, further bolstering the asset’s credibility. The launch of a spot Bitcoin ETF in the US, the largest capital market globally, could have a seismic impact on the cryptocurrency market, attracting significant inflows of capital.

As the price of Bitcoin continues to rise, the number of Bitcoin holders with wallets valued over $1 million is expected to increase. Additionally, the influx of high net worth individuals into the Bitcoin market will contribute to the growth of the cryptocurrency’s user base. This trend presents an opportunity for Bitcoin Minetrix, which offers both capital and income growth potential. Bitcoin Minetrix owners not only benefit from the cryptocurrency’s investment story but also receive mining rewards. Moreover, tokenized cloud miners within the Bitcoin Minetrix ecosystem can take advantage of the highly profitable Bitcoin mining industry without incurring the expenses associated with mining rigs.

An interesting aspect of the Bitcoin market is the diminishing supply of Bitcoin on exchanges. Currently, Bitcoin balances on exchanges are at a five-year low. This supply shock thesis further supports the notion that a spot Bitcoin ETF could have a substantial impact on the market. As more investors buy and hold Bitcoin, the available supply on exchanges decreases, potentially driving the price even higher.

The rising Bitcoin price, coupled with the success of the Bitcoin Minetrix ICO, demonstrates a growing interest in cryptocurrencies and their potential as investment assets. With expectations of a spot Bitcoin ETF approval on the horizon, the cryptocurrency market is poised for further growth and mainstream adoption. Investors and traders should closely monitor these developments and assess the potential opportunities they present in the ever-evolving landscape of cryptocurrencies.

Leave a Reply