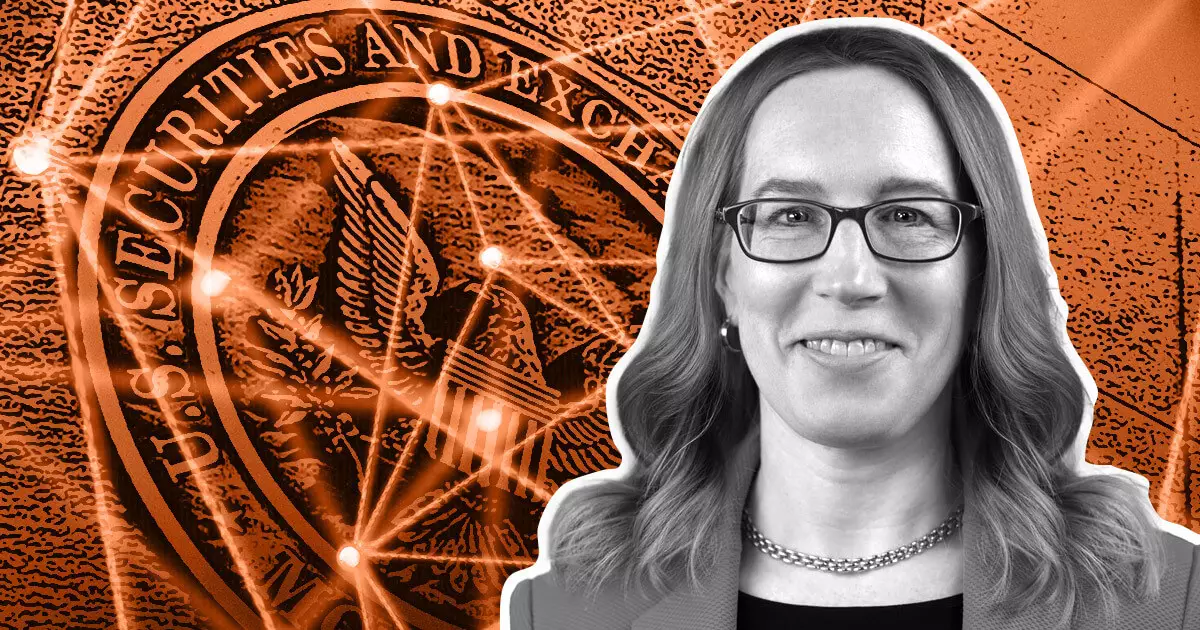

The discussion surrounding spot Bitcoin exchange-traded funds (ETFs) has been gaining momentum, with major asset managers like BlackRock and Fidelity applying for these investment vehicles. In a recent conversation with CNBC, SEC Commissioner Hester Peirce highlighted the increasing interest from both firms and investors in Bitcoin ETFs. She acknowledged that these applications are a reflection of the public’s growing interest in such products.

While the interest in Bitcoin ETFs is evident, Peirce cautioned investors against trying to predict regulatory agencies’ actions regarding these applications. She refrained from commenting on whether the U.S. Securities and Exchange Commission (SEC) is prepared to approve a spot Bitcoin ETF. However, she emphasized her personal support for such an investment vehicle, dating back to 2018.

Peirce also mentioned that recent court rulings unfavorable to the SEC have had an impact on the landscape. In August, a court specified that the SEC must review a Bitcoin ETF application from Grayscale. October’s developments suggest that the SEC will not attempt to appeal this outcome. These rulings have become an important factor in shaping the regulatory approach towards Bitcoin ETFs.

The Impact of Recent Events

Peirce acknowledged that recent events have not been positive for the image of the crypto industry. The collapse of FTX and Coinbase’s decision to open a new derivatives division overseas have raised concerns. In light of these developments, Peirce believes regulators should consider alternative approaches to make the United States a more viable location for crypto companies. She also expressed that there is a widening interest among lawmakers in creating effective regulations surrounding cryptocurrency, particularly within Congress.

As a regulator, Peirce holds a liberal view on her role in overseeing investments. She emphasized that it is not the SEC’s responsibility to dictate which assets investors can or cannot invest in. Instead, the SEC’s role is to provide proper disclosures for investors. However, Peirce advised investors to approach their investments with skepticism and to thoroughly evaluate what they are buying.

Commissioner Peirce has been vocal about her disagreement with her agency’s decisions related to cryptocurrencies. She has consistently opposed the SEC’s cryptocurrency enforcement actions and has criticized broader policy proposals concerning asset safeguarding and exchange definitions. Peirce’s stance highlights the need for a more nuanced and adaptable regulatory framework for the ever-evolving crypto industry.

The interest and demand for Bitcoin ETFs are growing, as major asset managers like BlackRock and Fidelity express their interest in these investment vehicles. However, the regulatory approval for spot Bitcoin ETFs remains uncertain. Recent court rulings and unfavorable industry events have shaped the landscape and prompted discussions on regulatory approaches. Commissioner Peirce’s progressive approach to regulation urges investors to be cautious and skeptical of their investment choices. Overall, the future of Bitcoin ETFs relies on a balanced regulatory framework that addresses the industry’s needs while protecting investors and fostering innovation.

Leave a Reply