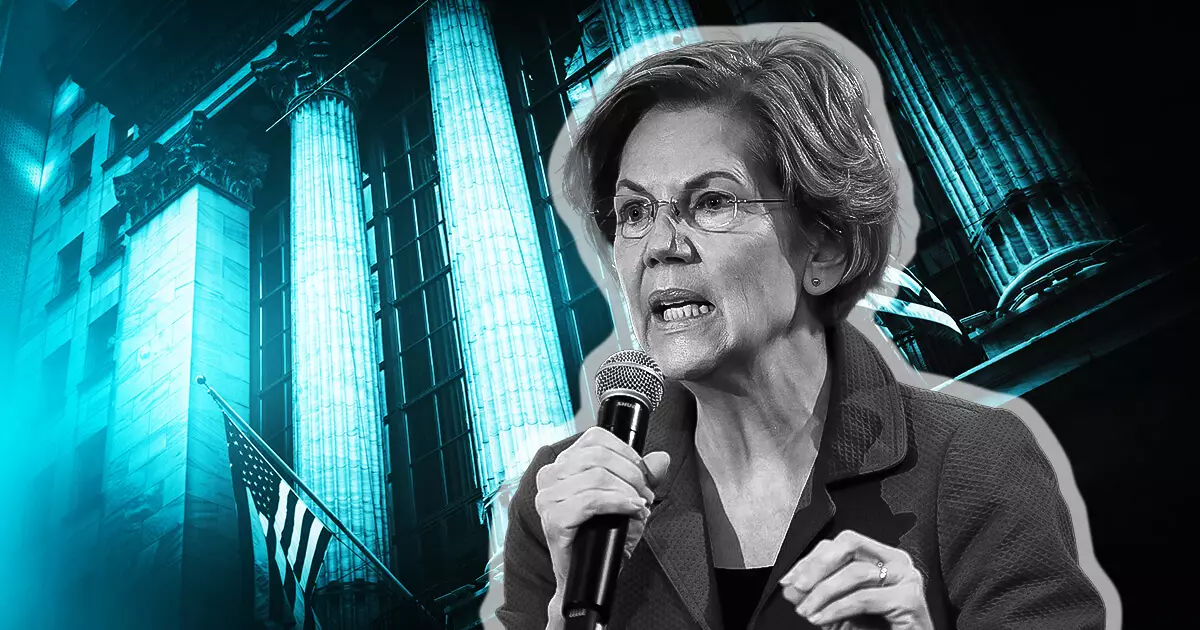

In a surprising turn of events, U.S. senator Elizabeth Warren has reintroduced the Digital Asset Anti-Money Laundering Act with backing from the Wall Street banks. This legislation aims to address the national security risks associated with cryptocurrencies, a topic that Warren and the Bank Policy Institute have historically disagreed on. The bipartisan bill seeks to crack down on crypto crime and equip regulators with the necessary tools to prevent cryptocurrencies from falling into the wrong hands.

Cryptocurrencies have emerged as the “payment method of choice” among cybercriminals, creating a pressing need for regulation. With this in mind, Warren emphasizes the importance of the proposed legislation in combatting crypto-related crimes. By imposing the obligations of the Bank Secrecy Act (BSA) on crypto wallet providers, miners, and validators, the bill aims to ensure that these entities adhere to strict know-your-customer requirements.

One of the key features of the bill is the establishment of a compliance examination and review process by the Treasury Department. This process will ensure that all crypto money service businesses fulfill their anti-money laundering and countering the financing of terrorism (AML/CFT) obligations under the BSA. Additionally, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) will be directed to implement similar review processes for crypto businesses under their purview.

To strengthen oversight and accountability, the bill introduces several reporting and record-keeping requirements. Crypto service providers must file a Report of Foreign Bank and Financial Accounts (FBAR) with the Internal Revenue Service when a U.S. customer conducts crypto transactions over $10,000 using offshore accounts. This ensures that financial authorities have visibility into potentially suspicious transactions.

Furthermore, the Financial Crimes Enforcement Network (FinCEN) will implement a rule to address the regulatory gap created by self-custody wallets. Under this rule, banks and money service businesses will be mandated to verify customer and counterparty identities, maintain records, and file reports for specific crypto transactions involving self-custody wallets or wallets hosted in non-compliant jurisdictions.

The bill also addresses the risks posed by cryptocurrency ATMs. FinCEN will enforce a requirement for ATM owners and administrators to regularly report and update the physical addresses of their kiosks. Additionally, ATM operators will be responsible for verifying the identity of customers and counterparties for all transactions conducted.

Recognizing the risks associated with anonymity-enhancing technologies, the bill instructs FinCEN to provide guidance to financial institutions on how to handle, use, or transact with cryptocurrencies that have had their origin obfuscated using mixers or similar technologies. By doing so, the legislation aims to ensure that banks and other financial institutions are well-equipped to address the challenges associated with these technologies.

The support of the Bank Policy Institute, composed of major Wall Street banks, highlights the growing consensus on the need for regulatory reform in the cryptocurrency space. This rare alignment of interests underscores the urgency to address the risks posed by cryptocurrencies and bring them under the same regulatory umbrella as traditional banking.

The Digital Asset Anti-Money Laundering Act represents a significant step in the regulation of cryptocurrencies. By imposing BSA obligations, enhancing compliance oversight, and introducing reporting requirements, the legislation aims to mitigate the national security risks associated with cryptocurrencies. As cryptocurrencies continue to gain popularity, it is imperative to establish comprehensive regulatory frameworks to prevent their misuse and ensure the integrity of the financial system.

Leave a Reply