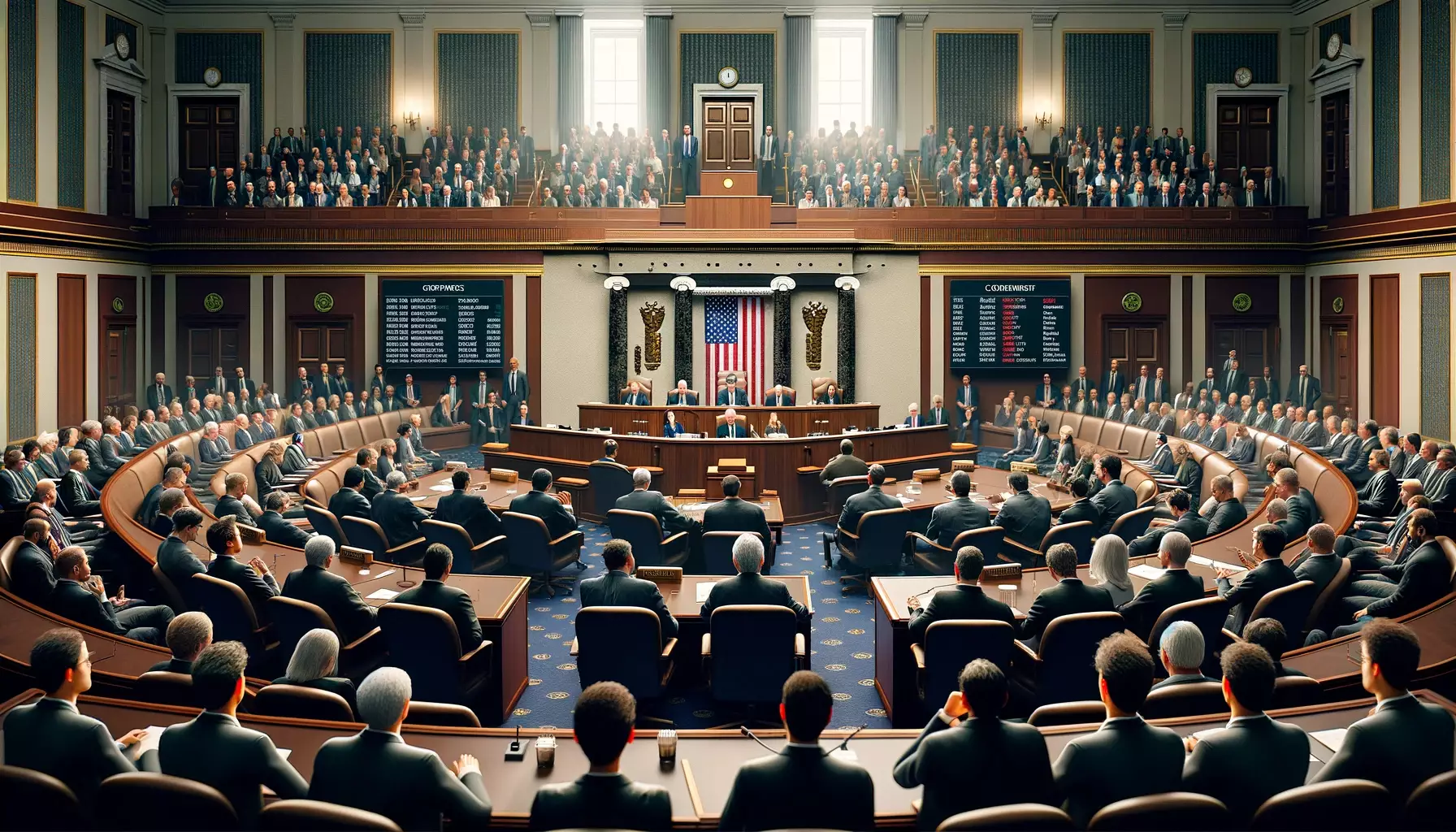

The U.S. House Subcommittee on Digital Assets, Financial Technology, and Inclusion recently convened a hearing titled “Crypto Crime in Context: Breaking Down Illicit Activity in Digital Assets.” The purpose of the hearing was to shed light on the nature and extent of criminal activities within the digital asset ecosystem. Experts in blockchain technology, financial regulation, and law enforcement provided testimonies, sparking a critical debate on the potential underreporting of illicit activities in cryptocurrency.

Alison Jimenez, an anti-money laundering (AML) expert and president at Dynamic Securities Analytics, challenged prevailing arguments made by crypto proponents. Her testimony highlighted a concerning issue: the scale of criminal activities in the crypto world may be larger than widely perceived. Jimenez conducted a critical analysis of transaction volume metrics and found that while physical cash can also be used for anonymity, cryptocurrencies enable a higher volume and speed of movement. This raises questions about the efficacy of existing regulatory frameworks in monitoring and controlling illicit activities.

One important topic discussed during the hearing was the role of crypto exchanges in facilitating criminal transactions. Jimenez’s testimony shed light on the lack of transparency in off-chain transactions, challenging the notion that the inherent transparency of blockchain technology is sufficient for deterring and tracking illicit activities. This insight raises concerns about the effectiveness of current regulatory frameworks in monitoring and controlling exchanges.

Bill Hughes, a veteran software engineer from ConsenSys, emphasized the need for effective policies to combat digital asset-related illicit finance. He stressed the importance of public blockchain transparency in tracking illicit activities and called for strict regulation of centralized entities like exchanges. Hughes advocated for global regulatory cooperation and public-private partnerships in decentralized finance to deter criminal misuse of digital assets. He also positioned ConsenSys as a valuable resource for Congress in crafting nuanced regulations for the crypto industry.

Unveiling Criminal Finance with Blockchain Analytics

Jonathan Levin, co-founder and CSO of Chainalysis, a leading blockchain analytics firm, highlighted the capacity of public cryptocurrency blockchains for tracking illicit finance. He provided examples of how Chainalysis software assisted U.S. and Israeli authorities in disrupting terrorist cryptocurrency campaigns. Levin acknowledged that illicit activities in crypto represent a small fraction of overall transactions but noted gaps in the system, especially with unregulated foreign exchanges. He called for stronger domestic regulation and international collaboration to prevent jurisdictional arbitrage. Levin emphasized the importance of proper resourcing for agencies to fully leverage blockchain transparency and highlighted the role of public-private partnerships in enhancing blockchain analytics capabilities.

Jane Khodarkovsky, a former DOJ prosecutor, acknowledged the dual nature of blockchain technology, which can be both legitimately used and susceptible to criminal exploitation. She argued for strict enforcement of existing anti-money laundering laws to counter illicit finance. Khodarkovsky pointed to public blockchain transparency as a valuable tool for law enforcement, aiding in investigations and supporting prosecutions. However, she expressed concerns about the lack of international regulatory standards that could enable crimes like sanctions evasion. Khodarkovsky advocated for international collaboration and emphasized the importance of nuanced policies that support both blockchain innovation and global law enforcement efforts.

Striking a Balance: Mitigating Risks Without Thwarting Innovation

Gregory Lisa, the Chief Legal Officer at DELV and a former DOJ prosecutor, discussed the risks associated with cryptocurrency and the benefits of blockchain transparency. Lisa cautioned against overstating the extent of crypto illicit activity, highlighting how public blockchains provide law enforcement with immutable records, an advantage over traditional financial systems. He warned about the role of non-compliant overseas exchanges in facilitating crime and called for sensible, measured regulation to mitigate risks without driving crypto activities underground. Lisa stressed the potential of blockchain analytics in fighting money laundering and urged for a reimagined approach to anti-money laundering policies that leverages the transparency of cryptocurrencies.

Shaping the Future: A Balancing Act Between Innovation and Security

The Congressional hearing served as a platform for a forward-looking approach to cryptocurrency regulation and innovation. The real-time testimonies from experts like Jimenez have contributed to a critical dialogue on the complexities of digital assets, illuminating a path toward a more secure and innovative financial future. As the debate continues, the focus remains on striking a balance between fostering innovation in the digital asset industry and ensuring robust security measures against money laundering and other illicit activities. The insights presented by the panel of experts will shape the future of the crypto industry and its regulation.

Leave a Reply