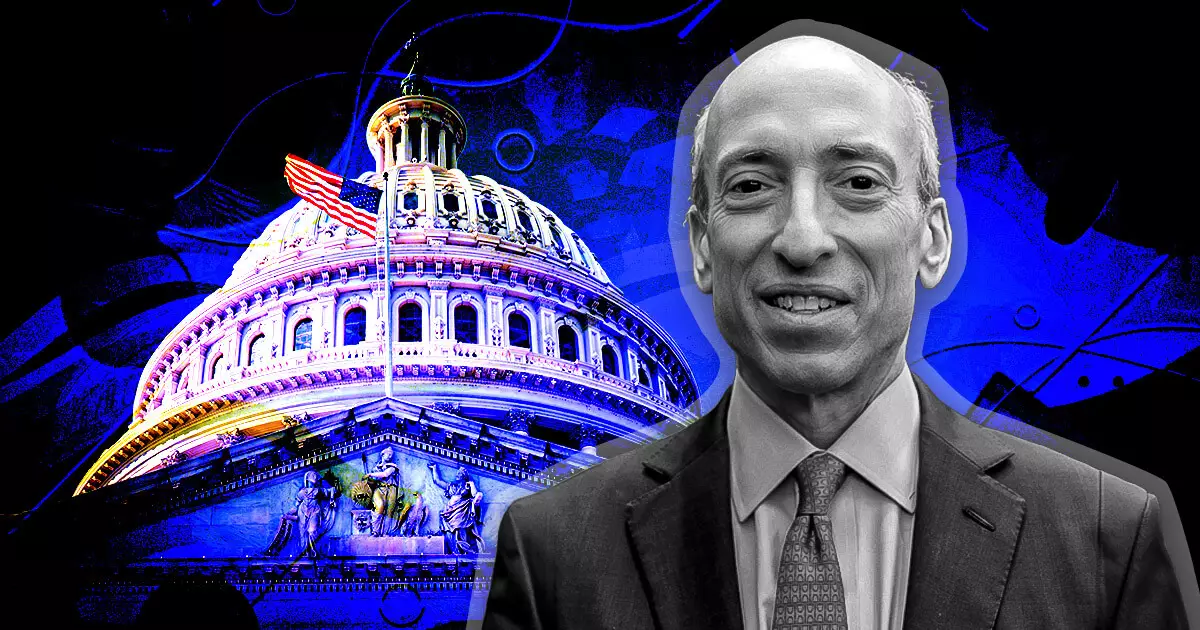

Securities and Exchange Commission (SEC) Chairman Gary Gensler is set to testify before Congress twice in September. These testimonies, scheduled for September 12th and September 27th, come in the wake of mounting criticisms and accusations from lawmakers, particularly Republicans, regarding Gensler’s approach to digital asset regulation.

One of the primary concerns raised by lawmakers, including Rep. Patrick McHenry, is the lack of explicit cryptocurrency guidelines indicating which digital assets fall under the jurisdiction of the SEC. Critics argue that Gensler’s regulatory approach is overly aggressive without providing clear guidelines for industry participants. The House Committee on Financial Services has even accused Gensler of making a “willful misrepresentation” of the non-existent registration process, further fueling the debate on the need for clear regulatory guidelines in the United States.

Despite the criticism, Gensler has maintained his stance on the need for regulation in the digital asset space. He asserts that most cryptocurrencies should be considered securities and regulated accordingly. In his previous testimony before the House Financial Services Committee, Gensler called out crypto firms for noncompliance with existing securities laws and reiterated the importance of registering with the SEC.

Rise of Prometheum Ember Capital LLC and Calls for Transparency

The recent regulatory approval of Prometheum Ember Capital LLC as a distinct broker-dealer for digital assets has raised eyebrows and prompted demands for transparency. Some view the approval as an attempt to showcase the adequacy of existing regulations in the digital assets sector. However, concerns have been raised due to Prometheum’s connections with Chinese entities and differing views on regulation. Lawmakers are calling for further scrutiny to ensure that the approval process was conducted thoroughly.

The criticisms directed at Gensler and the SEC highlight the pressing need for clear guidelines and regulatory clarity in the digital asset industry. Industry participants, including cryptocurrency firms, are increasingly finding themselves navigating uncertain regulatory terrain. Without explicit guidelines, businesses face difficulties in understanding their obligations and requirements.

Potential Impact on the Digital Asset Market

The ongoing debate surrounding digital asset regulation and the SEC’s approach could have significant implications for the digital asset market in the United States. Uncertain regulations may deter innovation and hinder the growth of the sector. Investors and consumers alike need clarity to feel confident in participating in the emerging digital asset landscape.

As Chairman Gensler gears up to testify before Congress, he will face further scrutiny and questioning from lawmakers seeking answers on his regulatory approach. The outcome of these testimonies and subsequent discussions will likely shape the future of digital asset regulation in the United States. Clarity, transparency, and cooperation between regulators, lawmakers, and industry participants will be essential in striking a balance between investor protection and fostering innovation in the rapidly evolving digital asset space.

Leave a Reply