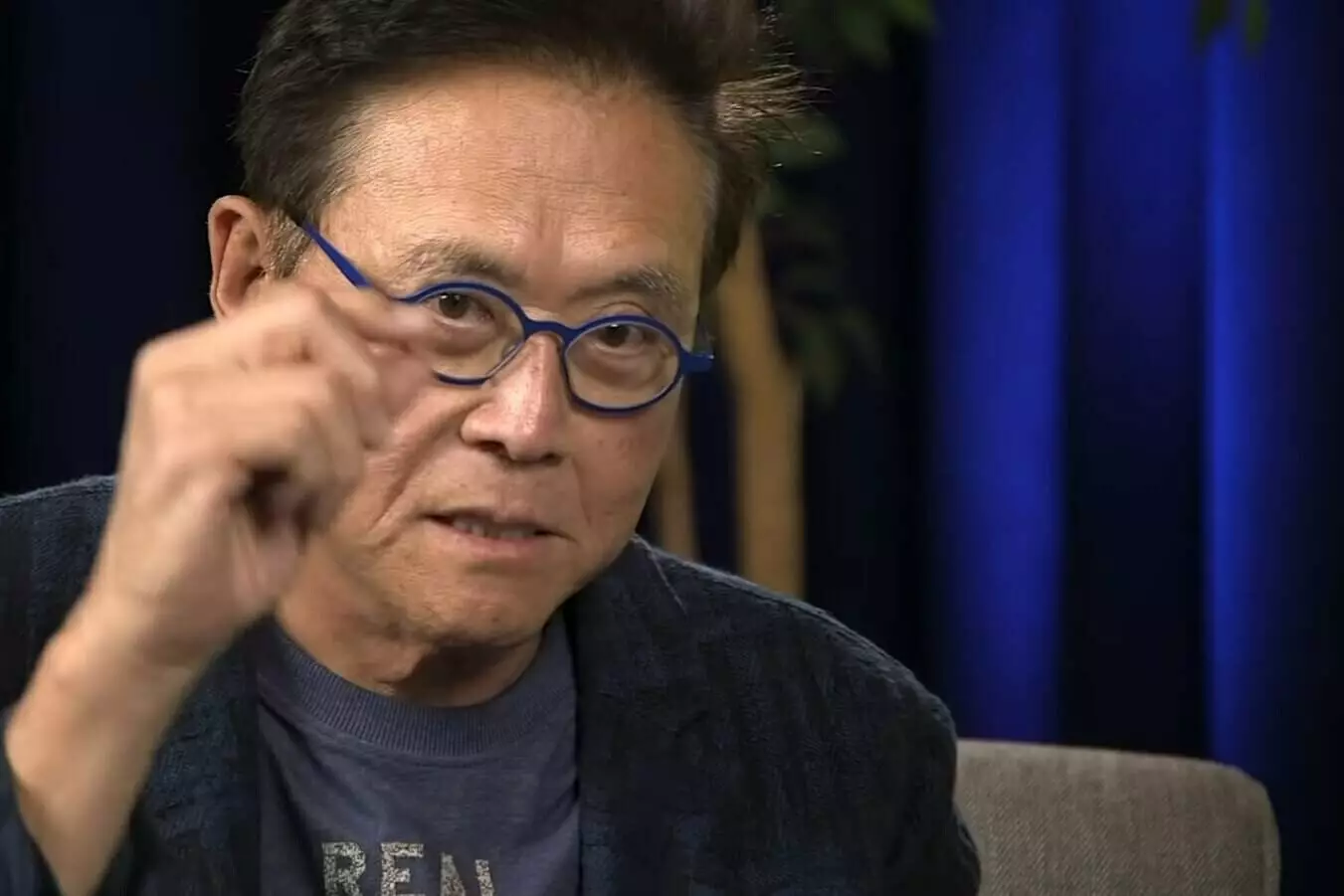

Robert Kiyosaki, renowned author of the best-selling book “Rich Dad Poor Dad,” has expressed his bearish sentiment towards the U.S. dollar following reports of an agreement among BRICS nations to establish a gold-backed currency. According to Russia Today (RT), this agreement is expected to be officially announced in August during an alliance summit in Johannesburg, South Africa. Kiyosaki’s prediction aligns with Standard Chartered’s recent Bitcoin price forecast, projecting a surge to $120,000 per coin by the end of 2024.

Kiyosaki has long been an advocate for both precious metals and Bitcoin as alternatives to traditional government-backed currencies. Known for his penchant for doomsday predictions regarding the U.S. economy and financial system, the author has consistently demonstrated a lack of confidence in the U.S. dollar. This sentiment has gained traction within the crypto community and has been echoed by influential figures such as Arthur Hayes, co-founder of BitMEX. Hayes believes that the world may soon experience a fragmentation into multiple currency blocs due to inflationary pressures on the USD.

Jeremy Allaire, CEO of Circle, has observed a significant de-dollarization movement driven by dwindling confidence in the U.S. banking system following the failure of Silicon Valley Bank. This sentiment extends beyond crypto enthusiasts, as even former U.S. President Donald Trump, a self-proclaimed Bitcoin skeptic, predicted the loss of the dollar’s status as the world reserve currency. Trump argued that the dollar’s decline would mark a historic defeat for the United States after two centuries of dominance.

Countries have already shown signs of shifting away from the USD in international trade. In March, Chinese and French energy companies reached an agreement to settle a liquified natural gas deal using the Chinese Yuan (CNY). Additionally, Brazil and China signed a deal to conduct trade using their respective currencies, bypassing the need for the U.S. dollar. These developments reflect a larger global trend away from relying on the USD as the primary medium of exchange.

The BRICS alliance, comprising Brazil, Russia, India, China, and South Africa, represents a significant challenge to the U.S. dollar’s dominance. The inclusion of economic powerhouses such as China and India, coupled with the potential establishment of a gold-backed currency, could catalyze a paradigm shift in the global currency landscape.

While it is important to consider varying perspectives on the future of the U.S. dollar, it is crucial to maintain a rational assessment of the situation. Kiyosaki’s predictions, although thought-provoking, should be taken with a grain of salt given his penchant for extreme forecasts. Furthermore, the prominence of Bitcoin and other cryptocurrencies as alternatives to traditional currencies remains a topic of ongoing debate.

The prospect of a gold-backed currency and the rise of BRICS pose significant challenges to the U.S. dollar’s status as the world reserve currency. Robert Kiyosaki’s prediction of the dollar’s demise and the subsequent surge in Bitcoin prices underscores a growing sentiment within the crypto community. However, it is essential to assess these predictions within the broader context of global economic dynamics and the potential impact of significant geopolitical shifts.

Leave a Reply