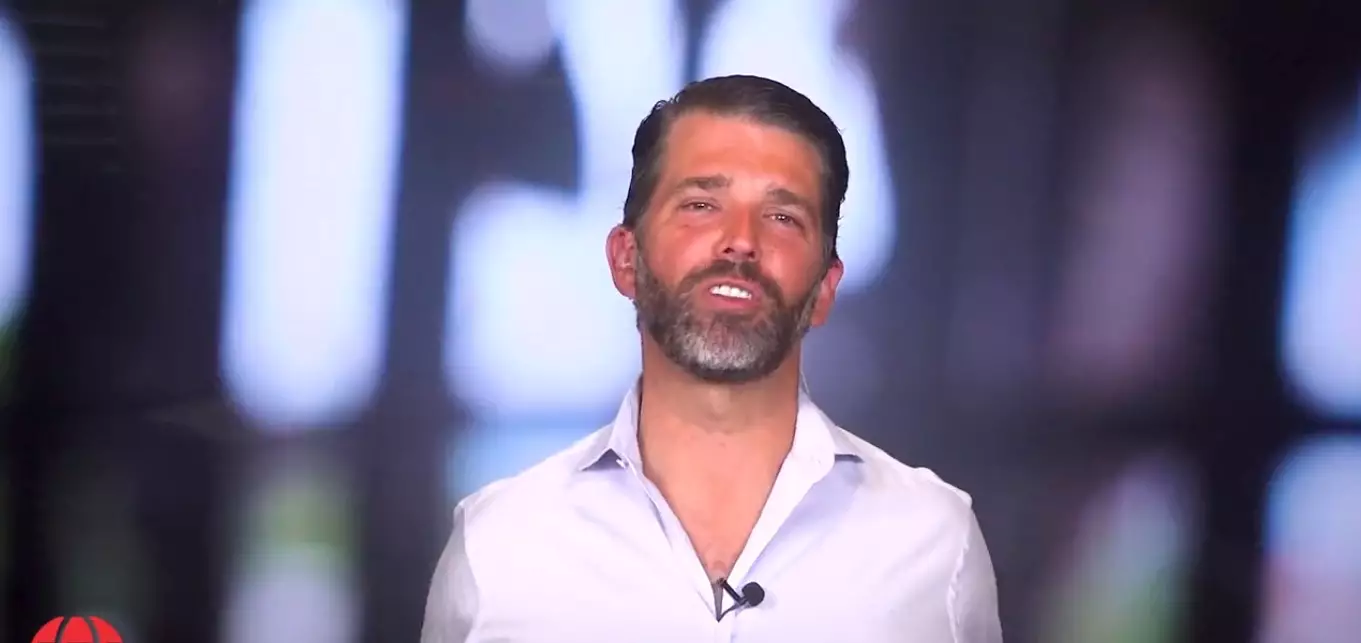

In a surprising turn of events, Donald Trump Jr.’s social media account, formerly Twitter, was hacked for approximately 30 minutes recently. During this time, a series of wild tweets were posted, touching on various controversial topics. These tweets included false information about Donald Trump Sr.’s death and a declaration from the hacker that he would run for president in 2024. Furthermore, the hacker took the opportunity to attack Elon Musk and criticized the former President’s hold on him. The hacker even changed the pinned tweet to contain foul language against President Joe Biden. The entire incident left many stunned and questioning the security measures in place on these platforms.

Thankfully, the hacking disruption was removed within an hour, and Donald Trump Jr.’s social media account was restored to its original state. In response to the controversy, Trump Jr. promptly deleted all the controversial tweets. A spokesperson for Trump Jr., Andrew Surabian, explained that the tweets were the result of a hack. While the immediate situation was resolved swiftly, it raises important concerns about the vulnerability of high-profile individuals’ social media accounts.

Interestingly, the hacking incident drew attention from the digital asset community due to the hacker’s tweet supporting an embattled crypto influencer facing criminal charges by the Securities and Exchange Commission (SEC). The hacker expressed their belief in the influencer’s innocence and even went as far as to state their intention to “burn the SEC” once they become president. This association with the crypto space underscores the interconnectedness of various online communities and the potential impact of hacking incidents on a larger scale.

Delving deeper into the SEC case surrounding Richard Heart, on July 31, he was charged with diverting at least $12 million of investor assets to fund personal luxury expenses, including sports cars, watches, and a 555-carat black diamond called The Enigma. Richard Heart gained prominence through his YouTube channel, where he promoted his crypto products, HEX and Pulse Chain. The SEC alleged that Heart raised over $1 billion through his unregistered product, HEX, by misleading investors with promises of significant wealth appreciation. Eric Werner, the director of SEC’s Fort Worth offices, emphasized the importance of protecting investors from such fraudulent schemes.

Richard Heart contends that his actions were a form of promoting free speech and challenges the Commission’s ability to showcase how he utilized investor funds. However, the SEC maintains that Heart failed to register his crypto asset securities offerings and deceived investors by misusing their funds for personal luxuries. This clash highlights the delicate balance between protecting investors and ensuring the freedom of expression within the digital asset space.

The hacking incident on Donald Trump Jr.’s social media account and its connection to the Richard Heart SEC case is a stark reminder of the vulnerability of online platforms and the potential consequences of such breaches. It also raises questions about the measures in place to safeguard high-profile individuals and the wider digital asset community. As technology continues to evolve, it is crucial that both individuals and regulatory bodies adapt to address these challenges and protect the interests of all involved.

Leave a Reply