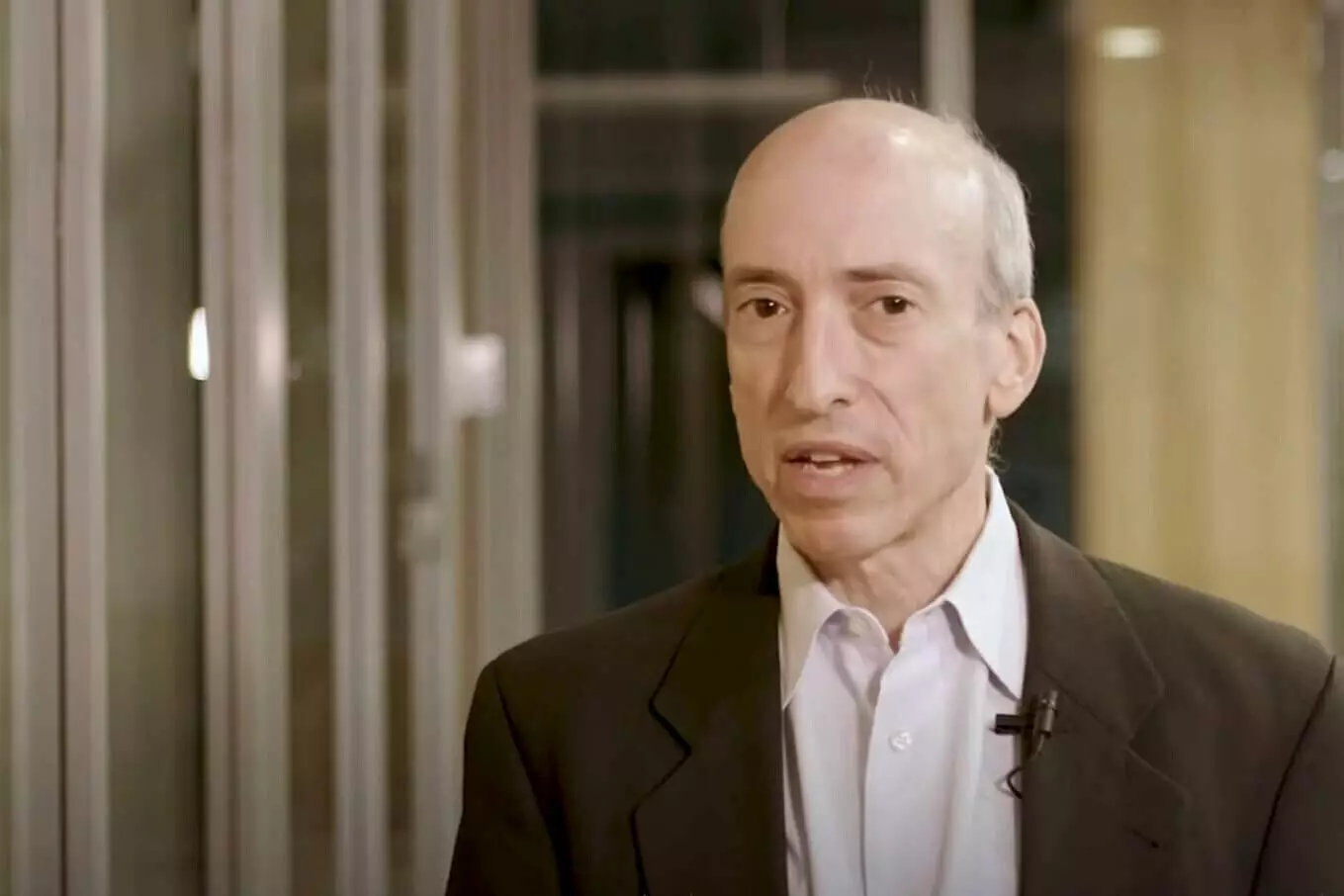

The recent court ruling declaring Ripple’s XRP token as “not in and of itself” a security has garnered mixed reactions. Securities and Exchange Commission (SEC) Chair Gary Gensler expressed his disappointment over the decision, emphasizing the potential impact on retail investors. In this article, we will analyze the implications of the ruling, the position of institutional investors, and the future of the crypto sector in the United States.

Disappointment over Retail Investor Protection

Chair Gensler acknowledged the court ruling’s positive aspect, which protects institutional investors by challenging the fair notice argument in the Ripple case. However, he expressed disappointment concerning the potential consequences for retail investors. While assessing the opinion further, Gensler remains concerned about the impact on this group of investors, who often have limited knowledge and resources to navigate the complex crypto market.

The court ruling stated that XRP does not necessarily constitute an “investment contract” or security on its own. Instead, the classification of the XRP token depends on its specific context of use. This approach recognizes the various ways in which XRP can be utilized, thereby avoiding a blanket determination that could stifle innovation within the crypto sector.

No Securities Offering through Programmatic Sales

One crucial aspect clarified by the court ruling pertains to Ripple’s “programmatic” sales of XRP. These sales involve the use of trading algorithms to sell the tokens held by the firm on exchanges. The ruling explicitly stated that such sales do not amount to a securities offering. This distinction helps clarify the regulatory landscape for cryptocurrency companies engaging in programmatic sales and provides more guidance on the boundaries of securities law.

Chair Gensler iterated that the SEC’s commitment to cleaning up the crypto sector in the United States will persist, irrespective of the Ripple court ruling. The regulatory authority aims to bring non-compliant firms into compliance while ensuring the protection of the investing public. Gensler’s statement indicates a continuation of the SEC’s aggressive crackdown on the crypto industry, which has been a focal point during his tenure.

The Ripple court ruling has had significant implications for the classification of XRP and the broader crypto sector. SEC Chair Gary Gensler’s disappointment over the potential impact on retail investors reflects the need for investor protection in the ever-evolving digital asset landscape. As the clean-up efforts continue, regulatory authorities will play a vital role in shaping the crypto sector’s future in the United States. Ultimately, a balance must be struck to foster innovation while safeguarding the interests of all market participants.

Leave a Reply