In a recent filing made on September 22, the co-founders of the now-defunct Terra blockchain project have been accused of planning to create fraudulent transactions during the development of the project. These allegations have been made by the Securities and Exchange Commission (SEC), which claims that Terraform Labs collaborated with a payments app called Chai to settle transactions on-chain. According to the SEC, the leaders of Terraform Labs “faked Chai payments onto the Terraform blockchain” while the actual payments were carried out traditionally. This article analyzes the implications of these alleged fraudulent activities and their impact on the Terra blockchain project.

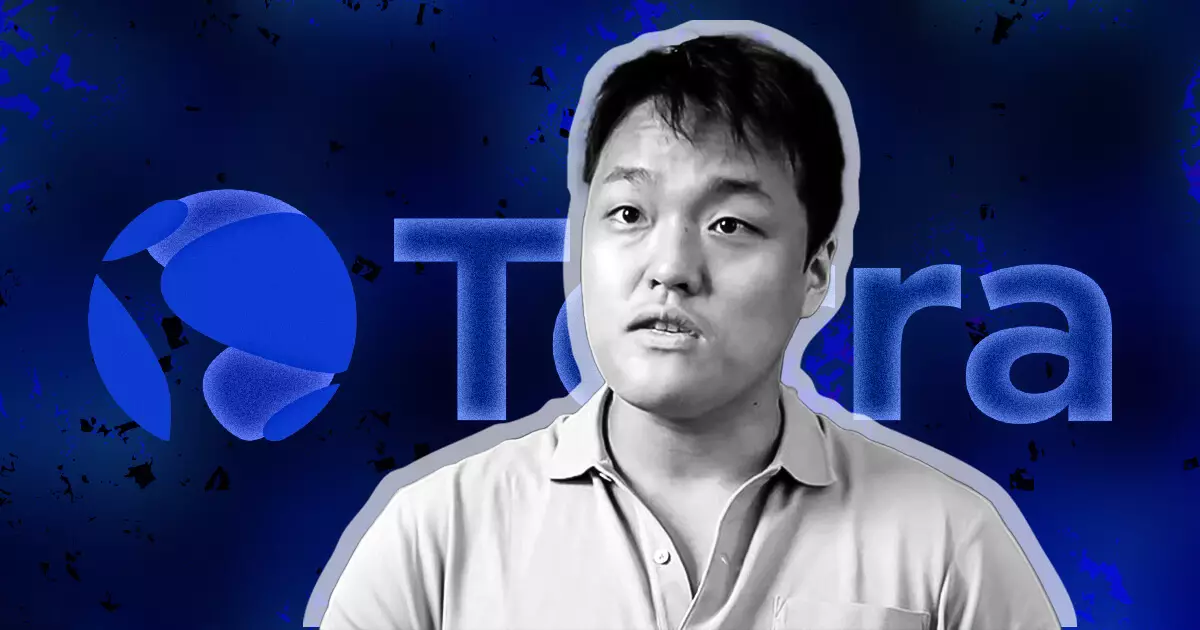

In chat logs dating back to 2019, the co-founders of Terraform Labs, Do Kwon and Daniel Shin, discussed their plans to falsify transactions to support their activities. Shin expressed concerns about end users discovering the falsified activity, to which Kwon replied that he would try his best to make it indiscernible. This conversation showcases the co-founders’ intent to create deceptive transactions and raises questions about the ethics and integrity of the project.

It remains unclear to what extent the co-founders actually falsified data in practice, as the partnership between Terraform Labs and Chai ended in 2020. However, the SEC claims that this partnership was successful in deceiving investors who bought “hundreds of millions of dollars” worth of LUNA and other tokens, believing that the Chai transactions were carried out on Terra’s blockchain. This revelation highlights the potential consequences of fraudulent activities and the trust that investors place in blockchain projects.

The SEC has included the chat logs as part of its filing to depose Do Kwon and obtain his testimony in a securities case. If the SEC’s request is successful, Kwon would be extradited from Montenegro, where he is currently serving a prison sentence for forgery of travel documents. This legal action signifies the severity of the allegations against the co-founders and emphasizes the importance of holding individuals accountable for fraudulent activities in the blockchain industry.

On September 27, defense lawyers attempted to challenge the SEC’s request, arguing that it would be impossible for Kwon to leave Montenegro. They also claimed that the chat logs discussed transactions related to staking rather than transactions related to the Chai partnership. This response raises further questions about the veracity of the allegations and the interpretation of the evidence presented by the SEC.

In February, the SEC initially filed charges against Terraform Labs, Do Kwon, and other entities involved in the project. The charges included allegations of unregistered securities sales and fraud. The alleged fraudulent transactions are part of the broader case against Terraform Labs, highlighting the regulatory scrutiny faced by blockchain projects and the potential consequences of non-compliance.

The alleged fraudulent transactions of the Terra blockchain project raise serious concerns about the integrity and trustworthiness of blockchain projects. The chat logs between the co-founders of Terraform Labs provide evidence of their intent to deceive and manipulate transactions. The legal implications of these alleged activities underscore the need for accountability in the blockchain industry. As the case unfolds, it will be crucial to assess the evidence, consider the defense’s arguments, and determine the extent of the fraudulent actions. The outcome of this case will have significant implications for the future of blockchain projects and the regulatory environment in which they operate.

Leave a Reply