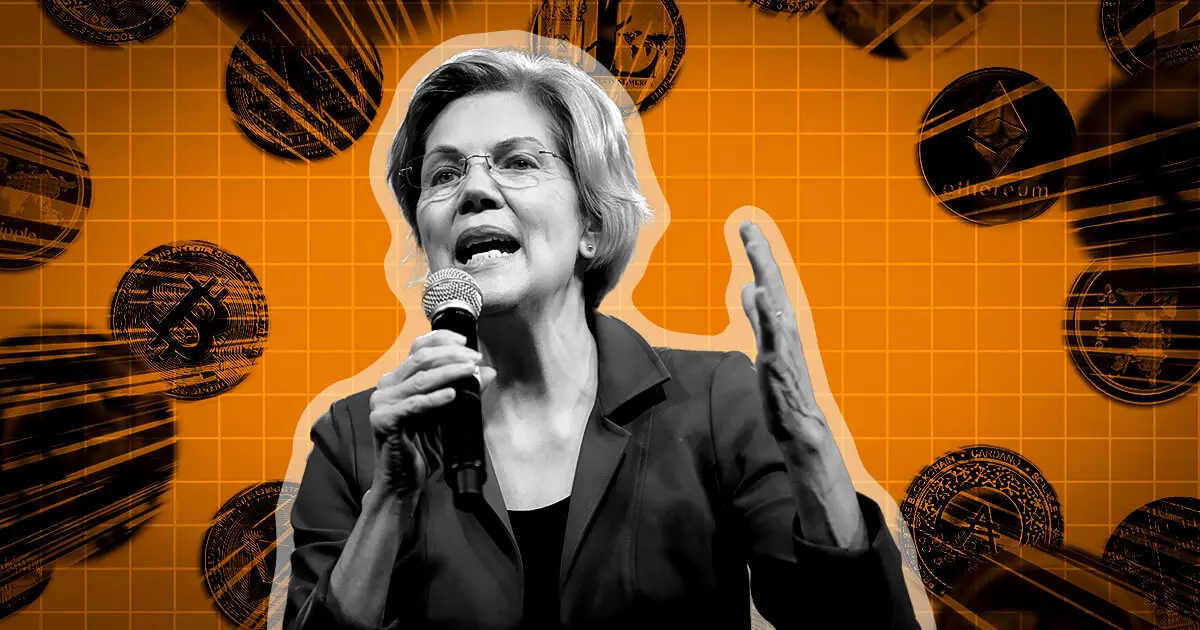

In a recent plea to Treasury Secretary Janet Yellen and IRS Commissioner Daniel Werfel, a group of US Senators led by Elizabeth Warren have called for immediate action on implementing new tax reporting requirements for digital asset brokers. The lawmakers reference the Infrastructure Investment and Jobs Act (IIJA), a bipartisan measure enacted nearly two years ago with the goal of addressing the estimated $50 billion crypto tax gap and simplifying the reporting process for taxpayers. However, despite the impending deadline, the Senators express concerns about the lack of progress in finalizing the rules.

The Senators emphasize the urgency of enforcing robust tax reporting rules for cryptocurrency brokers and highlight the potential failure of the Treasury Department and IRS to meet the congressionally-mandated deadlines. With the implementation deadline for the rules approaching in less than six months, the Senators stress the need for swift action. The IIJA was initially passed in response to the $1 trillion tax gap in the US, with the burgeoning $2 trillion cryptocurrency sector contributing to this issue. The Senators argue that the anonymity associated with crypto transactions poses significant challenges in detecting tax evasion and illegal activities. Therefore, the prompt implementation of robust tax reporting rules is deemed essential.

The new rules introduced by the IIJA have far-reaching implications for the crypto ecosystem. They require third-party brokers facilitating crypto transactions to report information on users’ crypto sales, gains or losses, and certain large transactions to the IRS and the users themselves. The Senators argue that these rules aim to simplify the tax filing process for crypto users and enable the IRS to effectively allocate its resources towards combating large-scale tax evasion. Moreover, the implementation of these rules is projected to generate an estimated $1.5 billion in tax revenue in 2024 alone and nearly $28 billion over the next eight years. The Senators underline the importance of timely implementation, cautioning that failure to do so by December 31, 2023, could result in a loss of $1.5 billion in tax revenue in 2024.

The call for prompt action comes at a time when Wall Street banks are backing Senator Elizabeth Warren’s Digital Asset Anti-Money Laundering Act, which aims to impose bank-like standards and requirements on crypto businesses. This legislation, along with the demand for robust tax reporting rules, signals a growing emphasis on traceability, oversight, and visibility in the regulatory landscape for the crypto industry in the US. As the sector continues to expand and gain popularity, regulators and lawmakers are seeking to ensure that it operates within a framework that addresses concerns related to money laundering, tax evasion, and other illicit activities.

The plea made by US Senators to implement robust tax reporting rules for digital asset brokers underscores the pressing need for increased transparency and accountability in the crypto industry. With the looming deadline for implementation, the Senators emphasize the potential consequences of delayed action, including the loss of significant tax revenue. The implementation of these rules is expected to simplify the tax filing process, enable more efficient use of IRS resources, and generate substantial tax revenue. As the regulatory landscape evolves, it is clear that the crypto industry in the US will face more stringent measures aimed at combating illicit activities and ensuring compliance with existing tax laws. The successful implementation of these rules will pave the way for a more regulated and secure crypto ecosystem.

Leave a Reply